Short Answer

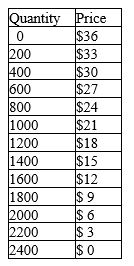

Assume that demand for a product that is produced at zero marginal cost is reflected in the table below.

a. What is the profit-maximizing level of production for a group of oligopolistic firms that operate as a cartel?

b. Assume that this market is characterized by a duopoly in which collusive agreements are illegal. What market price and quantity will be associated with a profit-maximizing Nash equilibrium?

c. Assume that this market is served by three identical firms who operate as independent oligopolists (no collusive agreements). What market price and quantity will be associated with a profit-maximizing Nash equilibrium? How does your answer differ from (b) above?

Correct Answer:

Verified

a.Q = 1200

b.Q = 1600,P = $12

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.Q = 1600,P = $12

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: When prisoners' dilemma games are repeated over

Q76: What happens to the outcomes of the

Q77: What is one characteristic of an oligopoly

Q78: Table 17-2<br>The information in the table depicts

Q79: Suppose that Firm A and Firm B

Q80: In a two-person repeated game,how does a

Q83: When will profit-maximizing production decisions drive price

Q84: In what type of market do the

Q85: When firms have agreements among themselves on

Q86: Scenario 17-2<br>Imagine that two oil companies, Big