Multiple Choice

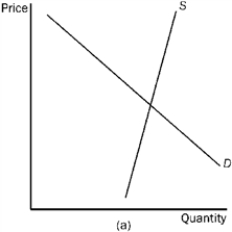

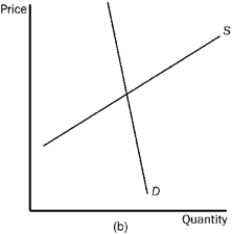

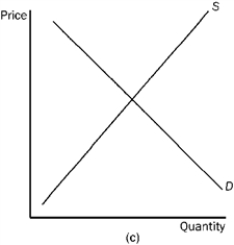

Figure 4-23

-Refer to Figure 4-23. In which market will the majority of the tax burden fall on the buyer?

A) market (a)

B) market (b)

C) market (c)

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q170: Lowincomesville is a poor town. The mayor

Q171: Figure 4-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-1

Q172: In his book The Road to Serfdom,

Q173: The actual burden of a tax is

Q174: A progressive tax is defined as a

Q176: Other things constant, a decrease in the

Q177: When government imposes price controls in a

Q178: When a government subsidy is granted to

Q179: Suppose the U.S. government banned the sale

Q180: An increase in the number of students