Multiple Choice

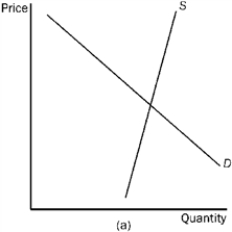

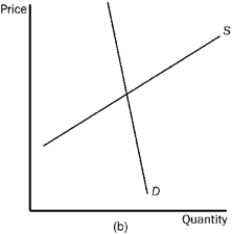

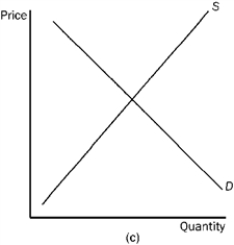

Figure 4-23

-Refer to Figure 4-23. In which market will the tax burden be most equally divided between the buyer and the seller?

A) market (a)

B) market (b)

C) market (c)

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q101: Use the figure below illustrating the impact

Q102: If a household has $40,000 in taxable

Q103: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-22

Q104: Which of the following would tend to

Q105: If a $500 tax is placed legally

Q107: Figure 4-21 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-21

Q109: A price ceiling set below an equilibrium

Q110: Under rent control, landlords cease to be

Q111: If Sophia's tax liability increases from $10,000

Q185: When a government subsidy is granted to