Multiple Choice

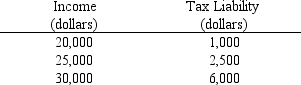

Use the table below to choose the correct answer.

The marginal tax rate on income in the $25,000 to $30,000 range is

A) 10 percent.

B) 20 percent.

C) 50 percent.

D) 70 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q40: A price ceiling that sets the price

Q51: Figure 4-2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-2

Q79: In 2010 the federal government reduced the

Q118: A price floor set above an equilibrium

Q162: Use the figure below to answer the

Q203: The term "deadweight loss" or "excess burden"

Q209: The more inelastic the demand for a

Q219: A tax for which the average tax

Q224: How would a decrease in lumber prices

Q289: Use the figure below to answer the