Multiple Choice

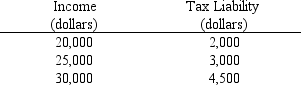

Use the table below to choose the correct answer.

The marginal tax rate on income in the $20,000 to $25,000 range is

A) 10 percent.

B) 12 percent.

C) 20 percent.

D) 30 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: If a household has $40,000 in taxable

Q39: When a supply and demand model is

Q48: If the federal government placed a 50

Q101: Use the figure below illustrating the impact

Q116: Because of price controls in the former

Q207: Compared to legal markets, black markets have<br>A)

Q214: A minimum wage that is set above

Q253: The Laffer curve indicates that<br>A) when tax

Q256: If a household has $40,000 in taxable

Q263: The average tax rate is defined as<br>A)