Multiple Choice

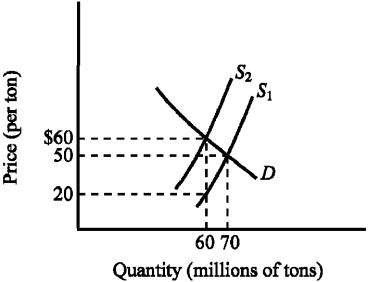

Use the figure below to answer the following question(s) .

Figure 4-8

-Refer to Figure 4-8.The supply curve S₁ and the demand curve D indicate initial conditions in the market for soft coal.A $40-per-ton tax on soft coal is levied,shifting the supply curve from S₁ to S₂.Imposing the tax increases the equilibrium price of soft coal from

A) $20 to $60 per ton.

B) $20 to $50 per ton.

C) $50 to $60 per ton.

D) $50 to $90 per ton.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Use the figure below to answer the

Q85: The deadweight loss resulting from levying a

Q88: If the government wants to raise tax

Q124: Which of the following examples illustrates a

Q162: The actual incidence (or burden) of a

Q168: Which of the following is the most

Q174: A progressive tax is defined as a

Q238: Which tax rate measures the percent of

Q240: The more elastic the supply of a

Q258: Which of the following is a true