Multiple Choice

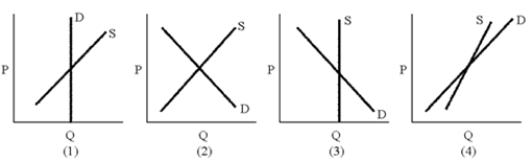

Figure 18-3

-In 1984, the South Carolina State Supreme Court ruled that a 20 percent admission tax on X-rated movies was unconstitutional.When the affected cinemas sought a refund of collected taxes, they were denied on the grounds that the tax, although collected by the theater, was indeed paid by the theatergoers.The Supreme Court apparently believed

A) the supply of X-rated movies was perfectly elastic.

B) the demand for X-rated movies was perfectly inelastic.

C) the legislation intended that the theatergoers pay the tax.

D) the burden fell on the theatergoers-there are no excess burdens on the theater.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: The Social Security Trust Fund<br>A)is insolvent relying

Q57: In Country X, the government requires employers

Q58: The incidence of a tax refers to<br>A)who

Q59: Consumers can avoid excess tax burden by

Q60: If Jenny's taxes are $10,000 when she

Q62: The second largest source of income for

Q63: If Bob is taxed for each soda

Q64: The way in which most persons pay

Q65: Faced with a shortage of funds to

Q66: If a corporation earns $1 million in