Multiple Choice

Table 13-1

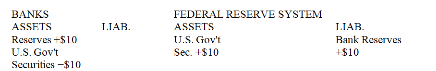

EFFECTS OF AN OPEN MARKET TRANSACTION ON THE BALANCE SHEETS OF BANKS AND THE FED (In millions of dollars)

-After the transaction in Table 13-1 is completed, what happens to actual reserves, required reserves, and excess reserves?

Assume the required reserve ratio is 25 percent.

A) Actual reserves increase by $10 million, required reserves increase $2.5 million, and excess reserves increase by $7.5 million.

B) Actual reserves decrease by $10 million, required reserves decrease $2.5 million, and excess reserves decrease by $7.5 million.

C) Actual reserves increase by $10 million, required reserves are unchanged, and excess reserves increase by $10 million.

D) Actual reserves decrease by $10 million, required reserves decrease by $10 million, and excess reserves are unchanged.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Why do economists insist on emphasizing the

Q83: If the Fed raises the discount rate,

Q87: The Fed's principal objective is to<br>A)make profits

Q94: Money is a concept that has a

Q103: Part of the reason that people confuse

Q109: Why is the Chair of the Fed

Q114: To decrease the money supply, the Fed

Q118: Figure 13-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2282/.jpg" alt="Figure 13-1

Q121: Recessions are typically associated with increases on

Q124: The Federal Reserve Open Market Committee includes