Multiple Choice

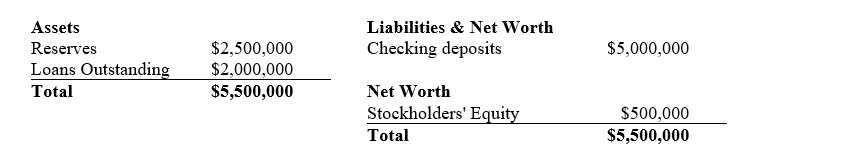

If the reserve ratio was 10% for the bank with the balance sheet listed below, then this bank is being

A) aggressive as indicated by a small amount of excess reserves.

B) aggressive as indicated by a large amount of excess reserves.

C) cautious as indicated by a small amount of excess reserves.

D) cautious as indicated by a large amount of excess reserves.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: The intended use of TARP funds was

Q24: Did President Obama's $787 billion fiscal stimulus

Q25: A bank would be considered insolvent when

Q40: The Federal Reserve stepped in to help<br>A)Bear

Q56: During the 2000 to 2006 time period,

Q57: Borrowed funds are used in financing every

Q59: Because the U.S.economy failed to snap back

Q60: Spending on newly constructed homes is part

Q62: Assuming that the reserve ratio is 10%,

Q64: Which of the following are accurate arguments