Short Answer

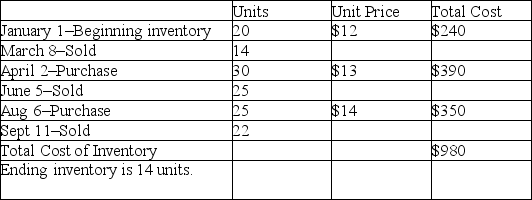

Casey Company's beginning inventory and purchases during the fiscal year ended December 31, 2012 were as follows: (NOTE: The company uses a perpetual system of inventory.)

What is the ending inventory of Casey Company for 2012 using FIFO?

Correct Answer:

Verified

$196

Calculation: Th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Calculation: Th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Inventory turnover equals the cost of goods

Q31: Which method of valuing inventory is based

Q32: 2012 ending inventory is $25,000; 2013 ending

Q33: The last step in using the gross

Q34: If the ending inventory in Period 1

Q36: Inventory is often the largest:<br>A) expense on

Q37: If a misstatement of inventory occurs, the

Q38: Journalize the following transactions for the next

Q39: Goods available for sale are $85,000; beginning

Q40: What is the method used to estimate