Multiple Choice

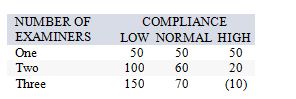

The local operations manager for the Internal Revenue Service must decide whether to hire one, two, or three temporary tax examiners for the upcoming tax season. She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Congress, as follows:  If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

A) $26,000

B) $46,000

C) $48,000

D) $50,000

E) $76,000

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Expected monetary value gives the long-run average

Q60: The advertising manager for Roadside Restaurants, Inc.,

Q63: The operations manager for a well-drilling company

Q64: The construction manager for Acme Construction, Inc.,

Q67: Consider the following decision scenario: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2632/.jpg"

Q69: Consider the following decision scenario: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2632/.jpg"

Q70: The construction manager for Acme Construction, Inc.,

Q129: The head of operations for a movie

Q159: Bounded rationality refers to the limits imposed

Q185: Departmentalizing decisions increases the risk of _