Essay

Table 14-10

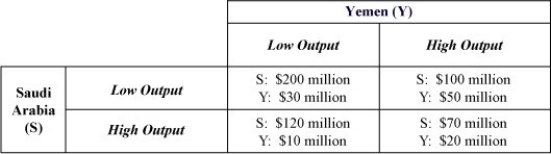

-Refer to Table 14-10.Suppose the payoff matrix in the above figure represents the payoffs to Saudi Arabia and Yemen for the production of oil.Saudi Arabia and Yemen must decide how much oil to produce.Since the demand for oil is inelastic, relatively low production rates drive up prices and profits.Saudi Arabia, the world's largest and lowest-cost producer, is able to influence market price; it has an incentive to keep output low.Yemen, on the other hand, is a relatively high-cost producer with much smaller reserves.Assume Saudi Arabia now decides to try to further influence the oil market by offering to pay Yemen $25 million to produce a low output.

a.Create a new payoff matrix that reflects Saudi Arabia's willingness to pay Yemen $25 million to produce a low output.

b.What is the dominant strategy for each country in this new game?

c.What is the new Nash equilibrium?

Correct Answer:

Verified

a.See payoff matrix below.

b.T...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.T...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: A market comprised of only two firms

Q41: In Porter's Five Competitive Forces model, "competition

Q65: Why are decision trees useful to managers

Q77: In an oligopoly market,<br>A)the pricing decisions of

Q106: Figure 14-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 14-4

Q123: What do Spotify and Apple have in

Q127: Explain how collusion makes firms better off.Given

Q149: Which of the following is not one

Q151: Competition in the form of advertising, better

Q234: Explain why OPEC is caught in a