Essay

Figure 18-3

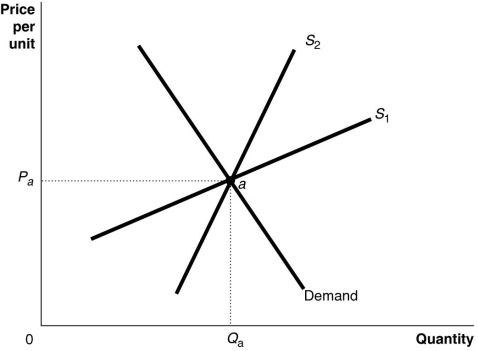

-Refer to Figure 18-3.The figure above shows a demand curve and two supply curves, one more elastic than the other.Use Figure 18-3 to answer the following questions.

a.Suppose the government imposes an excise tax of $1.00 on every unit sold.Use the graph to illustrate the impact of this tax.

b.If the government imposes an excise tax of $1.00 on every unit sold, will the consumer pay more of the tax if the supply curve is S₁ or S₂? Refer to the graphs in your answer.

c.If an excise tax of $1.00 on every unit sold is imposed, will the revenue collected by the government be greater if the supply curve is S₁ or S₂?

d.If the government imposes an excise tax of $1.00 on every unit sold, will the deadweight loss be greater if the supply curve is S₁ or S₂?

Correct Answer:

Verified

a.The supply curve shifts up by the full...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Rapid economic growth tends to increase the

Q46: What is the poverty rate?<br>A)the rate at

Q76: Table 18-9<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4192/.jpg" alt="Table 18-9

Q83: Article Summary<br>Monthly marijuana sales in Colorado topped

Q96: The proposition that the outcome of a

Q99: Figure 18-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-5

Q156: The idea that two taxpayers in the

Q200: Measures of poverty (for example, the poverty

Q230: A marginal tax rate is<br>A)the fraction of

Q251: A regressive tax is a tax for