Multiple Choice

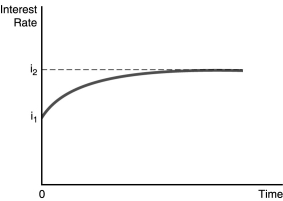

-In the figure above,illustrates the effect of an increased rate of money supply growth at time period 0.From the figure,one can conclude that the

A) liquidity effect is smaller than the expected inflation effect and interest rates adjust quickly to changes in expected inflation.

B) liquidity effect is larger than the expected inflation effect and interest rates adjust quickly to changes in expected inflation.

C) liquidity effect is larger than the expected inflation effect and interest rates adjust slowly to changes in expected inflation.

D) liquidity effect is smaller than the expected inflation effect and interest rates adjust slowly to changes in expected inflation.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The _ the returns on two securities

Q4: If the expected return on bonds increases,all

Q8: When stock prices become more volatile,the _

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2988/.jpg" alt=" -In the figure

Q23: The riskiness of an asset is measured

Q27: Milton Friedman called the response of lower

Q81: Everything else held constant,if the expected return

Q90: The riskiness of an asset that is

Q145: Of the four factors that influence asset

Q156: If the interest rate on a bond