Essay

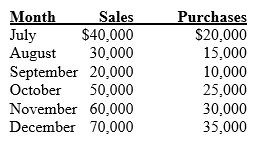

The following information pertains to Maxi Corporation:

∙ Cash is collected from customers in the following manner:

Month of sale 20%

Month following the sale 50%

Two months following sale 28%

Amount uncollectible 2%

∙ Thirty percent of purchases are paid for in cash in the month of purchase,and the balance is paid the following month. A 2% discount is allowed on purchases paid for in the month of purchase.

∙ Labor costs equal 20% of sales; other operating costs of $5,000 per month (including $2,000)of depreciation. Both are paid in the month incurred.

∙ The cash balance on October 1 is $4,300. A minimum cash balance of $4,000 is required at the end of the month. Money is borrowed in multiples of $1,000.

∙ The company will issue $6,000 of common stock and pay $10,000 in dividends in October.

∙ There is no debt outstanding at October 1.

Required:

Prepare a projected cash flow statement in good form for the month ended October 31.

Correct Answer:

Verified

**$7,350 + $7,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

**$7,350 + $7,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: For the next six months, Kurtz Company

Q48: The best label for the formula (AQ

Q49: Once authorized,discretionary spending budgets are committed or

Q50: Assume only the specified parameters change in

Q51: The role of budgeting in planning and

Q53: The use of low-quality raw materials is

Q54: Budgeting does NOT require:<br>A)knowledge of the organization's

Q55: Unfavorable variances arise when actual costs exceed

Q56: Discuss the terms discretionary expenditures and committed

Q57: _ occur(s)when a superior simply tells subordinates