Multiple Choice

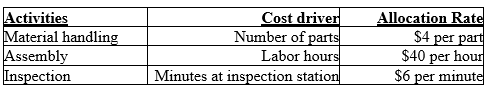

Merrill, Inc. manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead costs. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers:

The current traditional cost method allocates overhead costs based on direct labor hours using a rate of $ 400 per labor hour.

-What are the manufacturing overhead costs per remote control assuming the traditional cost method is used and a batch of 500 remote controls are produced? The batch requires 1,000 parts,10 direct labor hours,and 15 minutes of inspection time.

A) $4,000.00 per remote control

B) $0.50 per remote control

C) $4.00 per remote control

D) $8.00 per remote control

Correct Answer:

Verified

Correct Answer:

Verified

Q63: ABC systems:<br>A)reveal activities that can be eliminated.<br>B)help

Q64: The use of unit-related measures to assign

Q65: Design of an activity-based cost system requires

Q66: Brilliant Accents Company manufactures and sells three

Q67: Blitzer Enterprises has identified three cost pools

Q69: The Troubadours Company is noted for an

Q70: The most successful ABC projects occur when

Q71: When a company manufactures a variety of

Q72: Specialized engineering drawings of products,product quality specifications

Q73: Baldwin Printers has contracts to complete weekly