Multiple Choice

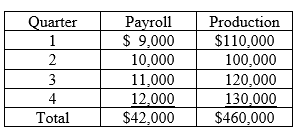

Aero Company has implemented a gain sharing compensation plan for its production employees. The plan is a Scanlon plan and the base period payroll costs are $10,000. The value of production in the base period was $100,000. The plan calls for labor savings to be added to, or excess labor costs to be deducted from, the bonus pool each quarter. The payroll costs and value of production in each quarter of the current year were:

-The bonus pool at the end of the year totals:

A) ($4,000) .

B) -0-.

C) $4,000.

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: What is stretch budgeting? Why is it

Q9: When management implements their own ideas without

Q10: A major role for management accounting and

Q11: All of the following are true regarding

Q12: In compensation plans,a cash bonus:<br>A)is based on

Q14: When a subordinate is caught padding an

Q15: An example of an intrinsic reward is

Q16: Monitoring is the process of measuring the

Q17: Information is relevant in a MACS if:<br>A)it

Q18: A primary purpose of an organization's code