Multiple Choice

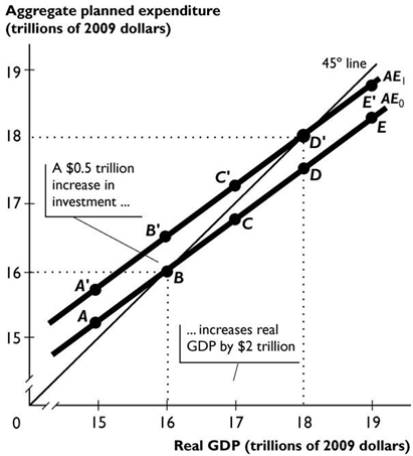

The figure above shows two aggregate expenditure lines.

The figure above shows two aggregate expenditure lines.

-In the figure above, what would happen to the size of the multiplier if marginal income tax rates were increased?

A) The multiplier would fall in value and might become negative.

B) The multiplier would fall in value but would not become negative.

C) The multiplier would rise in value.

D) The multiplier would not change in value.

E) More information is needed to determine the effect on the size of the multiplier.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Autonomous expenditure includes<br>A) investment, government expenditure on

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8401/.jpg" alt=" -The above table

Q44: A rise in the real interest rate

Q45: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8401/.jpg" alt=" -In the figure

Q46: When the change in unplanned inventories is

Q48: If disposable income decreases during a recession,

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8401/.jpg" alt=" -In the figure

Q50: When the real interest rate rises, there

Q51: When the price level increases, aggregate planned

Q52: If your planned consumption expenditure is $600