Short Answer

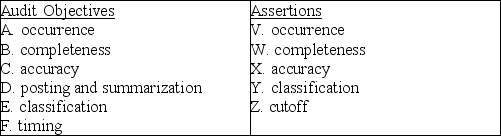

Below are five audit procedures,all of which are tests of transactions associated with the audit of the sales and collection cycle.Also below are the six general transaction-related audit objectives and the five management assertions.For each audit procedure,indicate (1)its audit objective,and (2)the management assertion being tested.

1.Vouch recorded sales from the sales journal to the file of bills of lading.

(1)________

(2)________

2.Compare dates on the bill of lading,sales invoices,and sales journal to test for delays in recording sales transactions.

(1)________

(2)________

3.Account for the sequence of prenumbered bills of lading and sales invoices.

(1)________

(2)________

4.Trace from a sample of prelistings of cash receipts to the cash receipts journal,testing for names,amounts,and dates.

(1)________

(2)________

5.Examine customer order forms for credit approval by the credit manager.

(1)________

(2)________

Correct Answer:

Verified

1.(1)A (2)V

2.(1)F (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2.(1)F (...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: If there is collusion among management, the

Q37: An auditor has a duty to<br>A) provide

Q40: The auditors determine which disclosures must be

Q60: If a client has violated federal tax

Q89: Audits are expected to provide a higher

Q96: Which of the following statements best describes

Q140: When developing the audit objectives, the first

Q145: In comparing management fraud with employee fraud,

Q150: An auditor should recognize that the application

Q177: Two overriding considerations affect the many ways