Multiple Choice

In audits of companies in which payroll is a significant portion of inventory,the improper account classification of payroll can

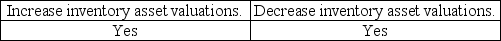

A)

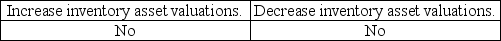

B)

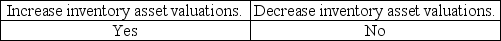

C)

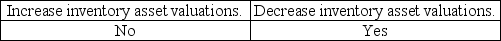

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Many audits have a _ risk of

Q8: Which of the following errors gives the

Q13: If an auditor wishes to test the

Q40: Match seven of the terms for documents

Q41: Auditors may extend their tests of payroll

Q42: To minimize the opportunity for fraud, unclaimed

Q97: An auditor traces a sample of electronic

Q98: It is generally more difficult for the

Q122: The nature, extent, and timing of substantive

Q130: Which of the following is a major