Multiple Choice

In audits of companies in which payroll is a significant portion of inventory, the improper account classification of payroll can:

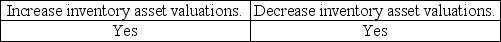

A)

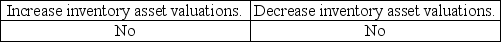

B)

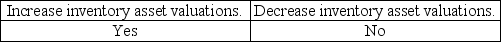

C)

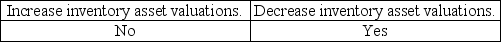

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: An analytical procedure to determine a possible

Q18: Mathews and Company has $112,000 in an

Q21: Auditors should determine whether the client has

Q46: Generally, is the inherent risk level for

Q55: Which of the following is an accurate

Q72: Discuss three important differences between the payroll

Q104: It is usually very easy for an

Q121: The computer file used for recording payroll

Q125: Records that include data about employees such

Q130: Which of the following is a major