Multiple Choice

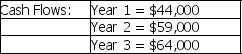

Design Quilters is considering a project with the following cash flows:

Initial Outlay = $126,000

If the appropriate discount rate is 11.5%,compute the NPV of this project.

A) -$14,947

B) $2,892

C) $7,089

D) $41,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q120: D&B Contracting plans to purchase a new

Q121: Whenever the internal rate of return on

Q122: All of the following are sufficient indications

Q123: Lithium,Inc.is considering two mutually exclusive projects,A and

Q124: The size disparity problem occurs when mutually

Q126: Both the profitability index (PI)and net present

Q127: What does a net present value profile

Q128: A significant advantage of the internal rate

Q129: Because the MIRR assumes reinvestment at the

Q130: Which of the following methods of evaluating