Multiple Choice

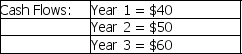

Compute the discounted payback period for a project with the following cash flows received uniformly within each year and with a required return of 8%.

Initial Outlay = $100

A) 2.10 years

B) 2.21 years

C) 2.33 years

D) 3.00 years

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q127: What does a net present value profile

Q128: A significant advantage of the internal rate

Q129: Because the MIRR assumes reinvestment at the

Q130: Which of the following methods of evaluating

Q131: A major disadvantage of the discounted payback

Q133: For any individual project,if the project is

Q134: If the NPV (Net Present Value)of a

Q135: Different discounted cash flow evaluation methods may

Q136: Free cash flows represent the benefits generated

Q137: A project's net present value profile shows