Multiple Choice

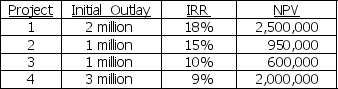

You are in charge of one division of Yeti Surplus Inc.Your division is subject to capital rationing.Your division has 4 indivisible projects available,detailed as follows:

If you must select projects subject to a budget constraint of 5 million dollars,which set of projects should be accepted so as to maximize firm value?

A) Projects 1, 2 and 3

B) Project 1 only

C) Projects 1 and 4

D) Projects 2, 3 and 4

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Lithium,Inc.is considering two mutually exclusive projects,A and

Q20: I301 Motors has several investment projects under

Q21: A machine that costs $1,500,000 has a

Q22: Project Alpha has an internal rate of

Q23: Mutually exclusive projects have more than one

Q25: A significant advantage of the payback period

Q26: The internal rate of return is the

Q27: Your company is considering a project with

Q28: Lithium,Inc.is considering two mutually exclusive projects,A and

Q29: A project with a NPV of zero