Multiple Choice

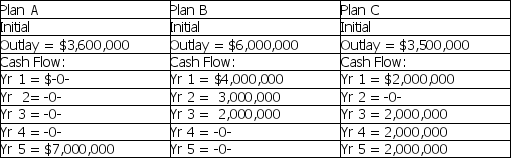

Interstate Appliance Inc.is considering the following 3 mutually exclusive projects.Projected cash flows for these ventures are as follows:

If Interstate Appliance has a 12% cost of capital,what decision should be made regarding the projects above?

A) accept plan A

B) accept plan B

C) accept plan C

D) accept Plans A, B and C

Correct Answer:

Verified

Correct Answer:

Verified

Q59: An acceptable project should have a net

Q60: When reviewing the net present profile for

Q61: A project would be acceptable if<br>A) the

Q62: Lithium,Inc.is considering two mutually exclusive projects,A and

Q63: Advantages of the payback period include that

Q65: A significant disadvantage of the internal rate

Q66: If the net present value of a

Q67: Which of the following statements about the

Q68: The internal rate of return is the

Q69: Because the NPV and PI methods both