Essay

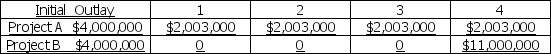

Consider the following two projects:

Net Cash Flow Each Period

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

b.What is the internal rate of return for each of the above projects?

c.Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above.

d.If 14 percent is the required rate of return,and these projects are independent,what decision should be made?

e.If 14 percent is the required rate of return,and the projects are mutually exclusive,what decision should be made?

Correct Answer:

Verified

a. NPV of A = $1,836,166 NPV of B = $2,5...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: One of the disadvantages of the payback

Q48: Determine the five-year equivalent annual annuity of

Q49: The profitability index provides an advantage over

Q50: If a project's profitability index is less

Q51: Project LMK requires an initial outlay of

Q53: Your firm is considering an investment that

Q54: The net present value method<br>A) is consistent

Q55: The payback period ignores the time value

Q56: Lithium,Inc.is considering two mutually exclusive projects,A and

Q57: One drawback of the payback method is