Essay

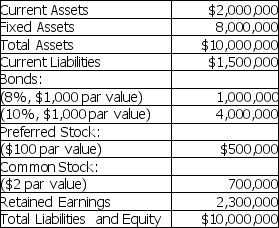

The MAX Corporation is planning a $4,000,000 expansion this year.The expansion can be financed by issuing either common stock or bonds.The new common stock can be sold for $60 per share.The bonds can be issued with a 12 percent coupon rate.The firm's existing shares of preferred stock pay dividends of $2.00 per share.The company's corporate income tax rate is 46 percent.The company's balance sheet prior to expansion is as follows:

MAX Corporation

a.Calculate the indifference level of EBIT between the two plans.

b.If EBIT is expected to be $3 million,which plan will result in higher EPS?

Correct Answer:

Verified

Correct Answer:

Verified

Q99: As the volume of production increases the

Q100: Corporations utilize external financing either because they

Q101: Potential applications of the break-even model include<br>A)

Q102: Jones Blanket Company sells blankets for $25

Q103: Kohler Manufacturing typically achieves one of three

Q105: Which of the following transactions will lower

Q106: Variable costs include all of the following

Q107: A plant may remain operating when sales

Q108: Bristal Boats,Inc.reports sales of $4,000,000,variable costs of

Q109: If fixed costs are $150,000,price per unit