Essay

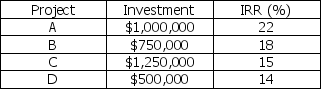

The Clydesdale Corporation has an optimal capital structure consisting of 70 percent debt and 30 percent equity.The marginal cost of capital is calculated to be 14.75 percent.Total earnings available to common stockholders for the coming year total $1,200,000.Investment opportunities are:

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected? Assume the marginal cost of capital is constant.

Correct Answer:

Verified

a. Select projects A,B,C for an investme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q73: A corporation decides to cut its dividend

Q74: The "bird-in-the-hand dividend theory" supports which view

Q75: Which of the following is true if

Q76: Expected dividends and share repurchases are the

Q77: Identify three reasons why a firm might

Q79: Cyberco Corporation has 5 million shares of

Q80: A firm's dividend policy includes two basic

Q81: Stock dividends<br>A) decrease stock prices because no

Q82: A firm's dividend policy includes two basic

Q83: The residual dividend theory implies that internally