Essay

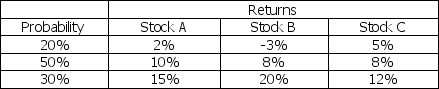

You are considering the three securities listed below.

a.Calculate the expected return for each security.

b.Calculate the standard deviation of returns for each security.

c.Compare Stock A with Stocks B and C.Is Stock A preferred over the others?

Correct Answer:

Verified

a.

RA = (.2)(2%)+ (.5)(10%)+ (.3)(15%)= ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a.

RA = (.2)(2%)+ (.5)(10%)+ (.3)(15%)= ...

RA = (.2)(2%)+ (.5)(10%)+ (.3)(15%)= ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q22: The expected return for the market portfolio

Q23: If you hold a portfolio made up

Q24: Stock A has a beta of 1.2

Q25: The T-bill return is used in the

Q26: Wildings,Inc.common stock has a beta of 1.2.If

Q28: The required rate of return for an

Q29: A security with a beta of one

Q30: A stock with a beta of 1

Q31: Stock A has the following returns for

Q32: Stocks that plot above the security market