Multiple Choice

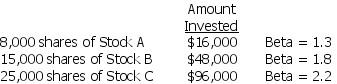

An investor currently holds the following portfolio:

If the risk-free rate of return is 2% and the market risk premium is 7%,then the required return on the portfolio is

A) 14.91%.

B) 15.93%.

C) 21.91%.

D) 23.93%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q44: You are considering a sales job that

Q45: If you were to use the standard

Q46: How can investors reduce the risk associated

Q47: Accounting profits is the most relevant variable

Q48: Changes in the general economy,like changes in

Q50: A typical measure for the risk-free rate

Q51: Redesign Corp.is considering a new strategy that

Q52: A rational investor will always prefer an

Q53: Bay Land,Inc.has the following distribution of returns:<br>

Q54: Marble Corp.has a beta of 2.5 and