Multiple Choice

You are going to add one of the following three projects to your already well-diversified portfolio.

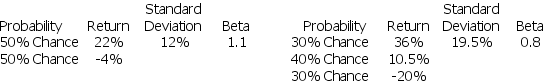

PROJECT 1 PROJECT 2

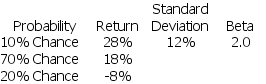

PROJECT 3

Assume the risk-free rate of return is 2% and the market risk premium is 8%.If you are a risk averse investor,which project should you choose?

A) Project 1

B) Project 2

C) Project 3

D) Either Project 2 or Project 3 because the higher expected return on project 3 offsets its higher risk

Correct Answer:

Verified

Correct Answer:

Verified

Q70: An all-stock portfolio is more risky than

Q71: Which of the following measures the average

Q72: Stock W has an expected return of

Q73: Assume that an investment is forecasted to

Q74: An investor currently holds the following portfolio:<br><img

Q76: Surf and Spray Inc.has a beta equal

Q77: Portfolio performance is determined mainly by stock

Q78: Decker Corp.common stock has a required return

Q79: You must add one of two investments

Q80: Asset allocation is not recommended by financial