Multiple Choice

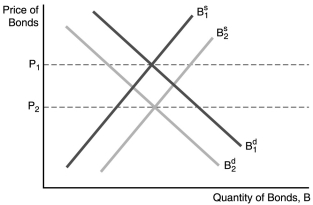

-In the figure above,the price of bonds would fall from P1 to P2 when

A) inflation is expected to increase in the future.

B) interest rates are expected to fall in the future.

C) the expected return on bonds relative to other assets is expected to increase in the future.

D) the riskiness of bonds falls relative to other assets.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: If the expected return on bonds increases,all

Q13: In Keynes's liquidity preference framework,individuals are assumed

Q36: When rare coin prices become volatile,the _

Q55: When the interest rate changes,<br>A)the demand curve

Q74: Everything else held constant,if the expected return

Q81: Everything else held constant,if the expected return

Q90: The riskiness of an asset that is

Q129: Everything else held constant,if interest rates are

Q142: If gold becomes acceptable as a medium

Q148: Holding the expected return on bonds constant,an