Multiple Choice

TABLE 15.1

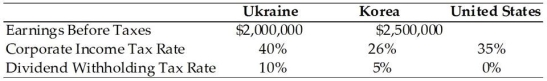

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. The additional U.S. taxes due on the repatriation of income from the Ukraine to the United States, alone, assuming a 50% payout rate, is:

A) excess foreign tax credits of $110,000.

B) additional U.S. taxes due of $97,000.

C) additional U.S. taxes due of $36,500.

D) excess foreign tax credits of $18,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Finance ministers of the G20 in conjunction

Q9: TABLE 15.1<br>Use the information to answer following

Q10: A _ tax policy is one that

Q11: The territorial approach, also referred to as

Q12: Which of the following is NOT an

Q15: _ is the pricing of goods, services,

Q16: Why is it core to Google's tax

Q17: What are the desired characteristics for a

Q18: Of the OECD 30 countries, most employ

Q77: Transfer pricing is a strategy that may