Multiple Choice

TABLE 15.1

Use the information to answer following question(s) .

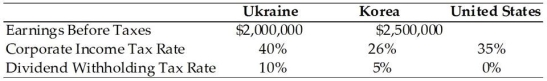

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. If BayArea set the payout rate from the Ukraine subsidiary at 25%, how should BayArea set the payout rate of the Korean subsidiary (approximately) to more efficiently manage its total foreign tax bill?

A) 28.5%

B) 24.5%

C) 42.6%

D) 82.3%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Use the information to answer the following

Q2: Among the G7 nations, the U.S. has

Q3: Bacon Signs Inc. is based in a

Q4: TABLE 15.1<br>Use the information to answer following

Q5: The issue of ethics in the reporting

Q7: In the mid-1980s, the U.S. led the

Q8: Finance ministers of the G20 in conjunction

Q9: TABLE 15.1<br>Use the information to answer following

Q10: A _ tax policy is one that

Q11: The territorial approach, also referred to as