Multiple Choice

TABLE 15.1

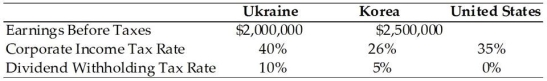

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. What is the minimum effective tax rate that BayArea can achieve on its foreign-sourced income?

A) 26%

B) 35%

C) 40%

D) 0%

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Explain the worldwide and territorial approaches of

Q33: A country CANNOT have both a territorial

Q34: One case of inversion is when a

Q35: What is the total value of taxes

Q36: Maximizing local profits in joint ventures overseas

Q38: Governments worldwide compete for global investment on

Q39: If a U.S. multinational remits profits from

Q40: Tax treaties generally have the effect of

Q41: Tax treaties typically result in _ between

Q42: A tax that is a form of