Multiple Choice

TABLE 15.1

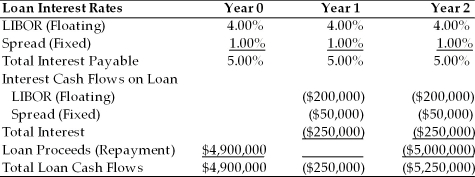

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer Table 15.1. What portion of the cost of the loan is at risk of changing?

A) the LIBOR rate

B) the spread

C) the upfront fee

D) all of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is NOT true?<br>A)

Q5: TABLE 15.2<br>Use the information to answer following

Q6: A basis point is _.<br>A) 1.00%<br>B) 0.10%<br>C)

Q7: Instruction 15.1:<br>For following problem(s), consider these debt

Q9: TABLE 15.1<br>Use the information for Polaris Corporation

Q14: An agreement to exchange interest payments based

Q16: A firm with variable-rate debt that expects

Q34: Which of the following is NOT true

Q35: An interbank-traded contract to buy or sell

Q63: Polaris Inc. has a significant amount of