Multiple Choice

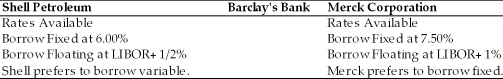

TABLE 15.2

Use the information to answer following question(s) .

-Refer to Table 15.2. Which of the following are viable rates for the swap agreements with Barclay's Bank by Shell and Merck?

A) Shell borrows at a variable rate of LIBOR + 1% and enters into a swap with Barclay's that pays Shell variable LIBOR + 1% while Shell pays Barclay's fixed 7 1/4%. At the same time, Merck borrows at the fixed rate of 6.00% and enters into a swap agreement with Barclay's that pays Merck 6.00% while Merck pays Barclay's LIBOR plus 1/4%.

B) Merck borrows at a variable rate of LIBOR + 1% and enters into a swap with Barclay's that pays Merck variable LIBOR + 1% while Merck pays Barclay's fixed 7 1/4%. At the same time, Shell borrows at the fixed rate of 6.00% and enters into a swap agreement with Barclay's that pays Shell 6.00% while Shell pays Barclay's LIBOR plus 1/4%.

C) Merck borrows at a fixed rate of 7.5% and enters into a swap with Barclay's that pays Merck variable LIBOR + 1% while Merck pays Barclay's fixed 7 1/4%. At the same time, Shell borrows at the variable rate of LIBOR + 1/2% and enters into a swap agreement with Barclay's that pays Shell 6.00% while Shell pays Barclay's LIBOR plus 1/4%.

D) Merck borrows at a variable rate of LIBOR + 1% and enters into a swap with Barclay's that pays Merck a fixed rate of 7% while Merck pays Barclay's variable LIBOR +1%. At the same time, Shell borrows at the fixed rate of 6.00% and enters into a swap agreement with Barclay's that pays Shell 6.00% while Shell pays Barclay's LIBOR plus 1/4%.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: The potential exposure that any individual firm

Q22: As a management tool, a _ is

Q40: The following would be an example of

Q40: Unlike the situation with exchange rate risk,

Q41: An agreement to swap the currencies of

Q48: A preferred interest rate swap strategy for

Q51: A U.S.-based firm with dollar denominated debt,

Q52: Instruction 15.1:<br>For following problem(s), consider these debt

Q53: Over the last decade floating-rate notes have

Q54: A firm entering into a currency or