Multiple Choice

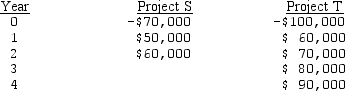

Dorati Inc. is considering two mutually exclusive projects. Dorati used a 15% required rate of return to evaluate capital expenditure projects. If the two projects have the costs and cash flows shown below, using a replacement chain determine the NPV for each.

Assume in two years Project S will still cost $70,000 and produce the same two years of cash flows.

A) NPVs = $8,860: NPVT = $109,240

B) NPVs = $14,690: NPVT = $109,240

C) NPVs = $40,020: NPVT = $109,240

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Rollerblade, a maker of skating gear, is

Q6: Lakeland Ramblers is considering two mutually exclusive

Q7: Quorex is evaluating two mutually exclusive projects.Project

Q7: The best way to measure projects with

Q8: The importance of time discrepancies depends on

Q10: Marvec needs to replace an extruder and

Q12: When two or more mutually exclusive alternative

Q12: Creative Furniture is considering two mutually exclusive

Q13: Toy Manufacturers (TM) is considering two mutually

Q14: What does a firm ignore if it