Multiple Choice

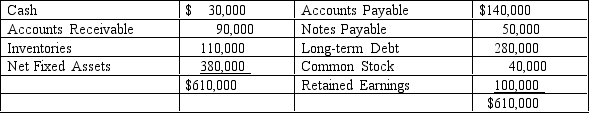

Lullaby Lane Bedding, Inc. needs to determine the amount of growth the firm could experience without having to obtain external financing. The current sales level is $800,000, the net profit margin is 6%, and the dividend payout ratio is 40%. Assume the firm is currently operating at full capacity and all assets will increase proportionately with sales. Lane's current balance sheet follows:

A) 6.53%

B) 1.09%

C) 11.97%

D) 13.50%

Correct Answer:

Verified

Correct Answer:

Verified

Q11: In using the percentage of sales forecasting

Q14: Peerless believes that its sales next year

Q16: Computerized financial planning models may be classified

Q18: _ is the statistical technique that helps

Q21: _ financial planning models seek to maximize

Q31: The Danville Company is considering a $50

Q40: In 1998, Hepler Company's sales were $26

Q61: Financial planning models have two classifications. What

Q61: The category "Cash and Cash Equivalents" includes

Q64: The value of debt and equity securities