Multiple Choice

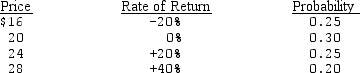

Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the coefficient of variation for the rate of return on Phoenix stock.

A) 0.0

B) 2.68

C) 2.61

D) 0.275

Correct Answer:

Verified

Correct Answer:

Verified

Q52: A portfolio is efficient if .<br>A)for a

Q65: The yield to maturity on ACL bonds

Q82: Beta is defined as:<br>A) a measure of

Q86: The _ is the ratio of _

Q88: The term structure of interest rates is

Q89: Find beta and determine the required rate

Q90: HDTV has planned on diversifying into the

Q104: The maturity premium reflects a preference by

Q108: The theory of the yield curve holds

Q114: Over the 10-year period from 1978 through