Multiple Choice

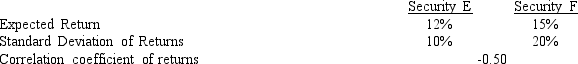

Given the following information on securities E and F, calculate the expected return and standard deviation of returns on a portfolio consisting of 40% invested in E and 60% invested in F.

A) 13.5%; 15%

B) 13.8%; 14.4%

C) 13.8%; 10.6%

D) 13.5%; 8.7%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Jim Bowles is an investor who believes

Q6: Dana has a portfolio of 8 securities,

Q24: Which of the following is not an

Q27: The _ correlated the returns from two

Q33: The slope of the characteristic line for

Q41: How can standard deviation, a statistical measure

Q43: All of the following statements about risk

Q52: An investor, by investing in combinations of

Q67: Christy is considering investing in the common

Q95: The security market line _.<br>A) is defined