Multiple Choice

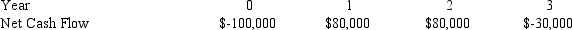

Calculate the net present value for an investment project with the following cash flows using a 12 percent cost of capital:

A) $56,560

B) $30,000

C) $13,840

D) cannot be determined with information given

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: The _ of an investment is the

Q2: Colex wishes to bid on a contract

Q3: The profitability index (PI) approach _.<br>A) fails

Q4: Which of the following investment decision rules

Q6: One weakness of the internal rate of

Q9: In the case of mutually exclusive projects,

Q10: What is the internal rate of return

Q58: In the absence of capital rationing, the

Q88: The "value additivity principle" means that the

Q93: Which of the following would increase the