Multiple Choice

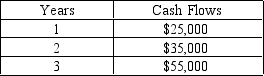

Should the following project be accepted if the cost of capital is 12%? Initial Investment is $50,000

A) Yes, because the internal rate of return is 10.5% which is less than 12%.

B) Yes, because the internal rate of return is 35% which is more than 12%.

C) No, because the internal rate of return is 8.7% which is less than 12%.

D) Yes, because the internal rate of return is 48% which is more than 12%.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: List the advantages and disadvantages of the

Q43: All of the following are reasons why

Q64: How does the profitability index differ from

Q74: The disadvantages of the payback approach include:<br>A)

Q77: Which of the following statements about comparing

Q78: Hydroponics is considering adding another greenhouse that

Q81: Why are there differences in the capital

Q83: With the net present value approach, all

Q95: Would you invest in a project that

Q98: The _ approach takes into account both