Multiple Choice

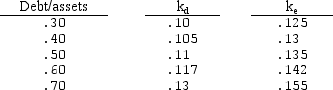

Feldspar Inc. is considering the capital structure for a new division. Management has been given the following cost information:

Based on this information, what capital structure (debt/asset ratio) should management accept? Assume the marginal tax rate is 40%.

A) 40% has lowest cost of capital

B) 50% has lowest cost of capital

C) 60% has lowest cost of capital

D) 70% has lowest cost of capital

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A survey of Fortune 500 firms indicate

Q3: When a corporation must get external financing,

Q3: There are many benefits to a leveraged

Q10: Calculate the market value of a firm

Q11: In considering a firm's capital structure, the

Q14: With financial leverage, a change in EBIT

Q26: Biotec has estimated the costs of debt

Q49: Investors' required returns and the cost of

Q55: Calculate the market value of Lotle Group,

Q66: In determining the capital structure for an