Multiple Choice

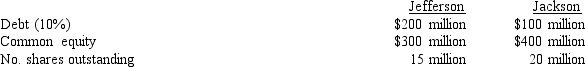

Two companies, Jefferson and Jackson, are virtually identical in all aspects of their operations except that the two companies differ in their capital structures, as shown below:

Both companies have $500 million in total assets and both have a 40% marginal tax rate.What is the EPS for Jefferson at an EBIT level of $50 million?

A) $-1.20

B) $ 1.20

C) $ 2.20

D) $ 3.33

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The total variability of the firm's EPS

Q10: In using Nestle Corporation as a model,

Q21: What are the effects of leverage on

Q38: In evaluating degree of operating leverage ,

Q42: A DFL (degree of financial leverage) of

Q47: Onex expects to have an EBIT of

Q48: ASG expects next year's operating income (EBIT)

Q64: Dippity Doodle Noodle Makers has a capital

Q82: Illinois Tool Company's (ITC) fixed operating costs

Q83: Some firms prefer to use debt or