Multiple Choice

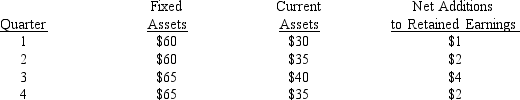

Barnes Company has highly seasonal sales and financing requirements. Barnes has made the following projections of its asset needs and net additions to retained earnings over the next year (in $ million) .

Net worth (equity) at the beginning of the year is $50 million. The company does not plan to sell any new equity during the coming year. Assume that Barnes follows a matching approach to finance its assets, i.e., long-term debt and equity are used to finance fixed and permanent current assets and short-term debt is used to finance fluctuating current assets. Determine the amount of long-term and short-term debt respectively outstanding at the end of the third quarter ($ million) .

A) $39; $2

B) $48; $0

C) $41; $7

D) none of the above/cannot be determined

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Explain how a firm uses commercial paper

Q42: Tefft Industries has an average inventory of

Q49: What is "stretching accounts payable," and what

Q56: Great Skot expects to have cash receipts

Q64: All other things being equal, a policy

Q72: The _ assets are those that are

Q73: A firm's net working capital position is

Q75: The _ is the optimal working capital

Q76: Runners Ink, Inc. had sales last year

Q78: The firm's inventory conversion period (measured in