Multiple Choice

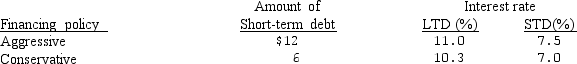

Laserscope Inc. is trying to determine the best combination of short-term and long-term debt to employ in financing its assets. Laserscope will have $16 million in current assets and $20 million in fixed assets next year and expects operating income (EBIT) to be $4.1 million. The company's tax rate is 40% and its debt ratio is 50%. The firm's debt will be financed by one of the following policies:

What is the return on shareholder's equity under each policy?

A) aggressive = 12.70% & conservative = 12.22%

B) aggressive = 8.47% & conservative = 8.14%

C) aggressive = 4.23% & conservative = 4.07%

D) aggressive = 7.67% & conservative = 8.81%

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Of the accounts listed, the account(s) that

Q18: In considering factoring accounts receivable, which of

Q22: Basically the overall working capital policy decision

Q24: The rate of return on fixed assets

Q52: If Swatch's inventory conversion period is 45

Q52: Last year, Bizmart had credit sales of

Q73: A firm's working capital position is important

Q75: Why is working capital so important to

Q76: All other things being equal, a policy

Q77: Net working capital is defined as _.<br>A)