Multiple Choice

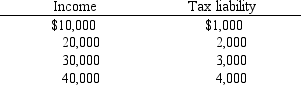

Use the table below to choose the correct answer.

For the income range illustrated, the tax shown here is

A) regressive.

B) proportional.

C) progressive.

D) progressive up to $30,000 but regressive beyond that.

Correct Answer:

Verified

Correct Answer:

Verified

Q81: The state of Florida is considering putting

Q95: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-22

Q141: Figure 4-24<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3951/.jpg" alt="Figure 4-24

Q165: Figure 4-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-20

Q202: Bill the butcher is upset because the

Q205: Figure 4-17 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-17

Q211: The Laffer Curve indicates that<br>A) when tax

Q227: Figure 4-24<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3951/.jpg" alt="Figure 4-24

Q246: The average tax rate (ATR) is defined

Q278: Figure 4-19<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3951/.jpg" alt="Figure 4-19