Multiple Choice

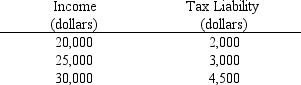

Use the table below to choose the correct answer.

The marginal tax rate on income in the $20,000 to $25,000 range is

A) 10 percent.

B) 12 percent.

C) 20 percent.

D) 30 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Use the table below to choose the

Q48: If the federal government placed a 50

Q75: A deadweight loss results from the imposition

Q82: A progressive tax<br>A) is one that taxes

Q94: The more elastic the supply of a

Q238: Which tax rate measures the percent of

Q242: If a $5,000 property tax is placed

Q269: Use the figure below to answer the

Q285: Which of the following is true?<br>A) Most

Q327: When a tax is imposed on a