Multiple Choice

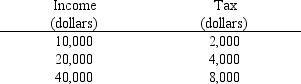

Use the table below to choose the correct answer.

The tax schedule shown here is

A) regressive.

B) proportional.

C) progressive.

D) proportional up to $20,000 and regressive beyond that.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: Use the figure below illustrating the impact

Q37: When the purchase of a good is

Q87: If Heather's tax liability increases from $10,000

Q104: Which of the following would tend to

Q123: The marginal tax rate is defined as<br>A)

Q213: If a $300 subsidy is legally (statutorily)

Q220: Use the figure below to answer the

Q239: A subsidy on a product will generate

Q247: A proportional tax is defined as a

Q257: Which of the following would occur following